Basics of Stock Market Scanners

Simplifying the Stock Market: A Comprehensive Dive into Stock Market Scanners

Last updated: Aug 1, 2023

Author: Nathan Nobert

What is a Stock Market Scanner?

Stock market scanners are powerful tools that help traders identify potential trading opportunities in the stock market. These scanners work by continuously monitoring the market and filtering stocks based on specific criteria or parameters set by the trader. When the scanner finds stocks that meet criteria, notifications can be sent to the trader.

When using a stock scanner, traders can define various filters such as price range, volume, or specific technical indicators. The scanner then searches through a vast database of stocks, instantly highlighting those that meet the specified criteria. This allows traders to focus their attention on stocks that have the potential to meet their trading strategies.

Key Takeaways

- - What is a stock market scanner?

- - How a stock market scanner can help you.

- - What stock market screeners do?

- - Features of a stock market scanner.

- - Are stock market scanners worth it?

- - How to get started with stock market scanners.

Understanding Stock Market Scanners

A stock market scanner is a sophisticated tool that uses computer technology to analyze vast amounts of information about stocks in the stock market. It helps traders quickly filter through this information to identify stocks that meet specific criteria or conditions.

Think of the stock market as a bustling marketplace with thousands of different products (stocks) being bought and sold every day. A stock market scanner is like a smart assistant that helps traders find the products they're interested in. It does this by processing large amounts of data, such as the current price of stocks, trading volume, company financials, and even news articles or social media sentiment related to the stocks.

Using a set of rules or filters defined by the trader, the stock market scanner sifts through this data to find stocks that meet the specified criteria. For example, a trader might use a scanner to find stocks that are priced below a certain amount, have high trading volume, and show signs of strong recent performance. The scanner's algorithms analyze the data and present a list of stocks that match these conditions, enabling the trader to focus on those particular stocks for further analysis or trading decisions.

In essence, a stock market scanner harnesses the power of technology and data analysis to streamline the process of finding potential trading opportunities. By automating the search and filtering tasks, it saves traders a significant amount of time and effort, allowing them to make more informed decisions based on the stocks that align with their preferred trading strategies.

Why Stock Market Scanners Are Essential for Traders

Stock market scanners play a crucial role in the toolkit of any trader, offering a range of benefits that can significantly enhance their trading experience. Let's explore why utilizing a stock market scanner is essential for traders looking to make informed and profitable trading decisions.

First and foremost, stock market scanners greatly improve efficiency. With countless stocks available in the market, manually sifting through them all to find potential trades can be a time-consuming and daunting task. Stock market scanners automate this process by rapidly analyzing vast amounts of market data, allowing traders to quickly identify stocks that meet their specific criteria. By streamlining the search process, scanners save traders precious time and enable them to focus on analyzing and executing trades rather than getting lost in a sea of information.

Consistency in trading decisions is another compelling reason to utilize stock market scanners. Emotions can often cloud judgment and lead to impulsive or biased trading choices. However, stock market scanners operate based on predefined rules and objective criteria. By relying on data-driven analysis, scanners reduce the influence of human emotions, resulting in more disciplined and consistent trading decisions. Traders can rely on the scanner's outputs to provide an unbiased view of the market, thereby supporting and guiding their trading strategies.

Key Features to Look for in a Stock Market Scanner

When selecting a stock market scanner, it's important to consider the key features that can greatly enhance your trading experience. Let's explore some essential features to look for when evaluating different stock market scanners.

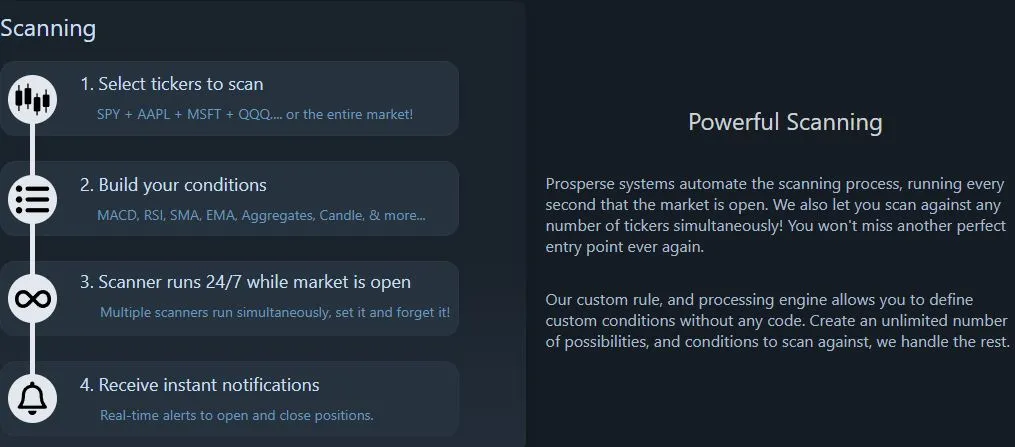

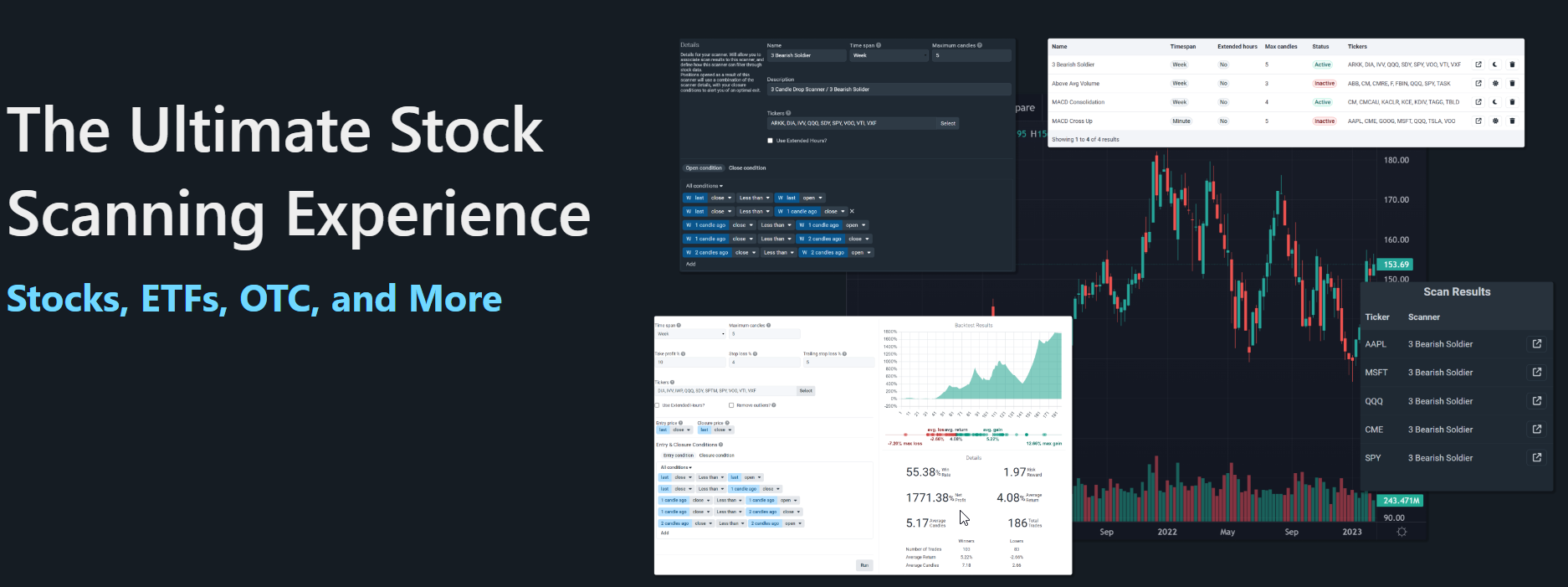

A stock market scanner that provides up-to-the-minute data ensures that you have access to the most current market information. Real-time data allows you to stay on top of market trends, spot potential trading opportunities, and make informed decisions. Look for a scanner that offers reliable and timely data updates, enabling you to react quickly to market changes.

Customization options are another crucial aspect to assess. A robust stock market scanner should offer flexibility in defining your own criteria and filters. This allows you to tailor the scanner to your specific trading style and preferences. Look for a scanner that enables you to set parameters or custom conditions, technical indicators, and more.

Alerts and notifications are invaluable features to keep you informed and updated. A stock market scanner that provides customizable alerts and notifications can be a game-changer. Look for a scanner that allows you to set alerts for specific events or conditions, such as price alerts. These notifications can help you stay proactive, even when you're not actively monitoring the market, ensuring you never miss important trading opportunities.

A well-designed and intuitive user experience and interface makes navigating the scanner effortless and enhances your experience. Look for a scanner that offers a clean and organized layout, easy-to-understand menus, and clear visual representations of data. Guides, lessons, and documentation helps you learn and use their systems to the fullest ability, use them! Find a scanner that you are excited to use!

Are Stock Market Scanners Worth It?

Absolutely! Stock scanners can be a game-changer for traders and make a significant difference in your success as a trader. Any edge that you can gain can compound your success, and therefore the amount of profit you can potentially earn.

The vast amount of information and the sheer number of stocks in the market can make it challenging to identify stocks with the most potential for profit. However, stock scanners sift through this overwhelming data, using advanced algorithms to analyze and identify stocks that meet your specific criteria. By leveraging this powerful technology, you can uncover stocks with favorable price movements, volume patterns, or technical indicators that align with your trading strategies. Missing out on such opportunities could mean missing out on potential profits and the chance to grow your portfolio.

Furthermore, stock scanners provide a level of efficiency that can save you valuable time and effort. Instead of manually scanning through numerous stocks, which can be both tedious and prone to human error, a stock scanner automates the process. It quickly scans the market, identifies stocks that match your criteria, and presents them to you in an organized manner. The freedom and relief knowing that an automated system is watching the market 24/7 for you can be very worthwhile.

How to Get Started with Stock Market Scanners

Ready to enhance your trading strategies and uncover hidden opportunities? Getting started with stock market scanners is simple and can revolutionize your trading experience.

Customize your trading criteria based on your preferences, such as price ranges, volume thresholds, and technical indicators. With our modern and advanced systems and algorithms, our stock market scanner ingests real-time data and scans your conditions continuously 24/7. Join our community of traders who are maximizing their potential with stock market scanners. Get started now and take your trading to the next level!

Trending News

No news available for this ticker. Please try again later, or another ticker