How to Find Undervalued Stocks

Best methods for finding undervalued stocks

Last updated: July 1, 2023

Author: Nathan Nobert

In the stock market, finding the right stocks to invest in can feel like searching for a needle in a haystack. A common strategy that has proven effective for many traders is investing in undervalued stocks. These are stocks that are trading for less than their intrinsic value, often due to market overlooks or temporary factors.

By identifying and investing in these undervalued stocks, traders can buy shares at a discount and potentially enjoy significant profits when the market corrects and the stock's price rises to its true value. Today we will break down how you can find undervalued stocks with Prosperse.

What is an Undervalued Stock?

An undervalued stock is essentially a share that is selling for less than it is truly worth, subjective to the traders value of this stock of course. This discrepancy between the stock's market price and its intrinsic value can occur due to a variety of reasons.

This analysis often involves examining key financial metrics such as earnings, revenue, cash flow, and debt, as well as factors like the company's competitive advantage, management quality, and market demand for its products or services.

The concept of "true worth" or intrinsic value is derived from fundamental analysis, you can read more about fundamental analysis

Understanding the Dynamics of Undervalued Stocks

While investing in undervalued stocks can be a profitable strategy, it's crucial to remember that stocks can remain undervalued for a long time. It can take a while for the market to recognize and correct a stock's undervaluation. Therefore, patience is key when investing in undervalued stocks.

A stock's price alone doesn't tell you much about its value. A stock trading at $5 per share is not necessarily more valuable than a stock trading at $100 per share. What matters more is the stock's price relative to factors like earnings, cash flow, market cap, and growth potential.

For instance, a company with strong earnings and growth potential trading at $100 per share could be undervalued, while a company with weak earnings and poor growth prospects trading at $5 per share could be overvalued.

Therefore, it's essential to look beyond the stock's price and evaluate its underlying fundamentals and growth prospects to determine whether it's truly undervalued.

Finding Undervalued Stocks Through Fundamental Analysis

An effective approach to finding undervalued stocks involves examining a company's growth over time and conducting technical analysis. Analyzing the stocks technicals with indicators could provide you with a better understanding of the stock's current price and its potential for future growth.

This is the premise of Fundamental Analysis, which is the process of analyzing a company's financial statements to determine its intrinsic value. Fundamental analysis is a popular approach to finding undervalued stocks, as it involves examining a company's financial statements to determine its intrinsic value.

Finding Undervalued Stocks Through Technical Analysis

Technical analysis involves studying statistical trends based on trading activity, such as price movement, volume, and indicators such as moving averages. Unlike fundamental analysis, which focuses on a company's intrinsic value, technical analysis looks at patterns in market data to predict future price movements.

Combining these methods can provide a comprehensive view of a stock's value. For instance, a stock that appears undervalued based on growth and fundamental analysis, and is showing bullish signals in technical analysis, could be a strong candidate for investment. However, as with any investment strategy, it's important to conduct thorough research and consider a range of factors before buying into a stock.

How to Find Undervalued Stocks

At Prosperse, we aim to simplify the process of finding undervalued stocks by providing a comprehensive suite of technical analysis tools. These tools can help you identify potential undervalued stocks based on various technical indicators. Here's how you can use some of these indicators to find undervalued stocks:

Simple Moving Average (SMA): The SMA is a technical indicator that calculates the average price of a stock over a specific period. If a stock's current price is significantly below its SMA, it could indicate that the stock is undervalued. However, it's important to consider other factors and indicators as well, as a low price relative to the SMA could also be a sign of a downward trend.

Moving Average Convergence Divergence (MACD): The MACD is a trend-following momentum indicator that shows the relationship between two moving averages of a stock's price. When the MACD line crosses above the signal line, it could be a bullish signal that the stock is undervalued and due for a price increase.

Relative Strength Index (RSI): The RSI is a momentum indicator that measures the speed and change of price movements. An RSI value below 30 typically indicates that a stock is oversold, which could mean it's undervalued. However, as with all indicators, it's important to use the RSI in conjunction with other analysis methods to confirm these signals.

Creating a Scanner for Undervalued stocks

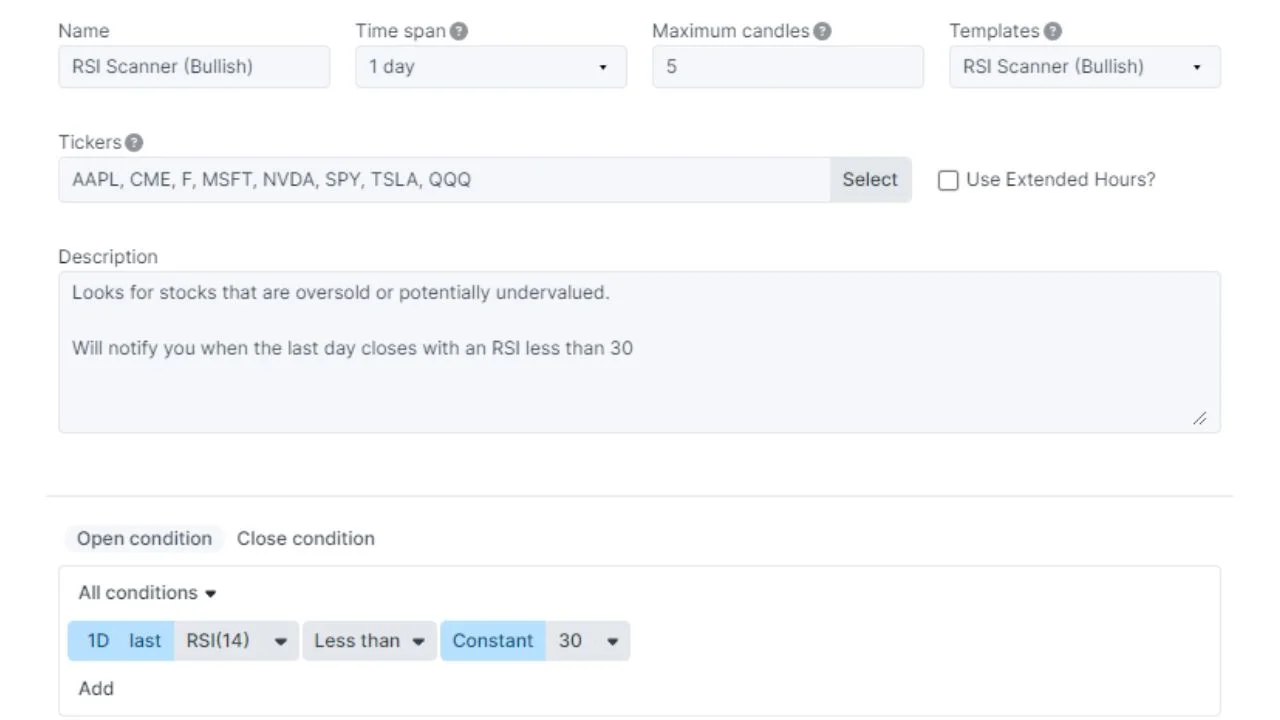

Its easy to create a scanner to that will notify you immediately when a stock could potentially be undervalued based on these technical indicators. Once logged into Prosperse, navigate to the Scanners page, and create a new scanner

We have some pre-built templates to get you started, in this example we will use an RSI scanner to notify us when any of the selected tickers have its RSI value close below 30 for the last day. Set any specific conditions you may want to adjust, such as the time span to scan on. Use weekly for longer periods of fluctuations, day for medium fluctuations, or even shorter for rapid day trading!

Save your scanner once you are happy with your settings, and sit back. Prosperse will automatically scan the market during market hours and instantaneously notify you if any stocks meet the criteria of your scanner.

Take action from these scan results by viewing the companies stock charts, researching the company, and even open a position if you are confident with your research. Prosperse lets you track positions to view your profit/loss and stay on top of your investments.

Conclusion

Investing in undervalued stocks can be a rewarding strategy, offering the potential for significant profits when the market corrects and the stock's price rises to its true value. However, identifying these opportunities requires a careful blend of fundamental analysis, growth evaluation, and technical analysis. It's important to remember that a stock's price alone doesn't determine its value, and that stocks can remain undervalued for extended periods.

At Prosperse, we provide a comprehensive suite of tools to simplify this process, helping you identify potential undervalued stocks based on a range of technical indicators. While these tools can provide valuable insights, they should be used as part of a broader investment strategy that takes into account your individual investment goals and risk tolerance.

Read more here

Trending News

No news available for this ticker. Please try again later, or another ticker