Investing 101: A Beginner's Guide to Making Your Money Work for You

Introduction to Investing

Last updated: April 14, 2024

Author: Nathan Nobert

Investing is essentially the act of allocating resources, usually money, with the expectation of generating an income or pr]ofit. The primary goal of investing is not just to grow your wealth but to outpace inflation, thereby increasing your purchasing power over time. For beginners, the world of investing might appear complex, but understanding a few basic principles can greatly simplify the process.

Key Takeaways

- - Educate yourself: Learn the basics before starting.

- - Set goals and assess risk: Know what you're investing for and how much risk you can handle.

- - Diversify: Spread your investments to reduce risk.

- - Think long-term: Focus on compound growth over time.

- - Review and adjust: Keep your portfolio aligned with your goals.

Why Invest?

- Wealth Accumulation: Investing can help you build wealth over time, especially through the power of compound interest. This is where your earnings generate their own earnings, a concept Albert Einstein once labeled as the eighth wonder of the world.

- Retirement Planning: Contributing to retirement accounts such as IRAs or 401(k)s, which often invest in stocks and bonds, can secure your financial future for when you are no longer working.

- Achieving Financial Goals: Whether it's buying a home, funding education, or preparing for any significant expense, investing can help you save enough funds more effectively than a typical savings account.

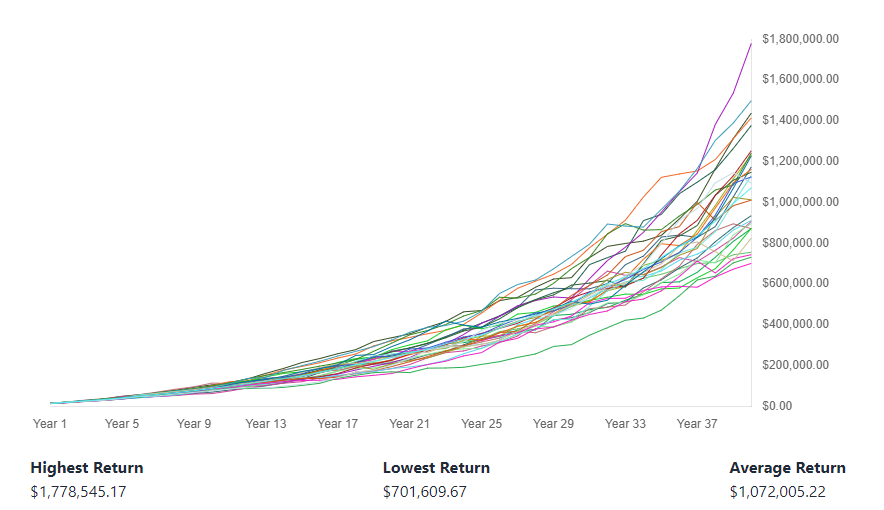

This simulation displays the power of compound investing over time. From a start of just $10,000, and an annual contribution of $5,000 at an expected interest rate of 7%, the investment grows to over $1 million in 40 years. You can test your own scenarios using our

Key Investment Avenues for Beginners

- Stocks: When you buy stocks, you buy ownership in a company. This ownership entitles you to a share of the profits (dividends) and gives you the right to vote at shareholders' meetings. Stocks have historically provided higher returns than other assets, which makes them attractive. However, they also come with higher risks, and their prices can be volatile.

- Bonds: These are essentially IOUs issued by governments or companies. When you buy a bond, you're lending money to the issuer for a predetermined period during which they pay you a fixed rate of interest. At the end of this period, the bond is matured and your original investment is returned to you. Bonds are typically less volatile than stocks and are considered safer investments.

- Mutual Funds: These funds collect money from many investors and use it to buy a diversified portfolio of stocks, bonds, or other securities. This diversification makes mutual funds less risky than individual stocks. They are managed by professional fund managers who are responsible for choosing the portfolio's composition and performing the necessary buying and selling of assets.

- Exchange-Traded Funds (ETFs): Similar to mutual funds, ETFs are collections of stocks, bonds, or other assets. However, unlike mutual funds, ETFs are traded on stock exchanges similar to individual stocks. This gives them greater flexibility and typically lower fees than mutual funds, making them a popular choice among both new and experienced investors.

Starting Your Investment Journey

- Educate Yourself: Understand basic financial concepts and how different investment vehicles work. There are numerous online resources, books, and courses available that cater to beginners.

- Set Clear Goals: Define what you are investing for and determine your time horizon. This will guide your investment choices and risk tolerance.

- Assess Your Risk Tolerance: Each person's ability to tolerate risk differs. Some might be okay with the possibility of a high return despite high risk, while others might prefer safer investments.

- Consult with Financial Advisors: If possible, seek advice from financial experts. They can provide personalized insights based on your financial situation and goals.

- Start Small: Begin with an amount you are comfortable with, and as you gain confidence and experience, you can increase your investment.

- Review and Adjust: Regularly review your investments to ensure they are performing as expected and make adjustments as needed based on changes in your financial situation or in the market.

By following these steps, beginners can effectively start their journey into the investing world, gradually building up knowledge and experience to optimize their financial strategies and achieve their long-term financial objectives.

1. Starting with Stock Market Investments

Investing in the stock market involves buying shares of publicly traded companies. Each share represents a piece of ownership in that company. When you buy shares, you are hoping the company will grow and perform well, so the value of your shares increases. Besides share price appreciation, some stocks also pay dividends, which are a portion of the company's earnings distributed to shareholders. We provide powerful

To begin investing in stocks:

- Open a brokerage account: This is an account where you can buy and sell securities.

- Understand the types of stocks: These include common stocks, which represent ownership and typically come with voting rights, and preferred stocks, which offer no voting rights but generally guarantee a fixed dividend payment.

- Start with established firms: As a beginner, it might be safer to start with blue-chip stocks—well-established companies known for their financial stability.

When analyzing the last 10 years of the S&P 500 ETF, its easy to see how there really is no "wrong" time to buy into the market. Over time your investments are extremely likely to gain value.

2. Bonds: What They Are and How They Work

Bonds are essentially loans you give to an issuer (like a government or corporation) in exchange for regular interest payments over the bond's life, plus the return of the bond's face value when it matures. Bonds are typically less volatile than stocks and are used by investors to preserve capital and generate steady income. Key concepts include:

- Issuer types: Government bonds (safest), municipal bonds (issued by states, cities), and corporate bonds (higher risk, higher yield).

- Interest rates: Bonds pay interest at fixed intervals, which is the main attraction for investors seeking predictable income.

- Maturity: The time at which the bond will pay back its face value. This can range from a few months to several decades.

3. Mutual Funds vs. ETFs: Choosing the Right Investment

Both mutual funds and ETFs allow you to invest in a diversified portfolio, but they operate differently:

- Mutual Funds: These funds pool money from many investors to purchase a portfolio of stocks, bonds, or other assets. Mutual funds are actively managed, meaning professionals are making decisions about how to allocate assets to achieve the best returns. They have higher expense ratios due to active management and typically only trade at the end of the trading day.

- ETFs: Exchange Traded Funds also pool investor money but are designed to track an index, a commodity, bonds, or a basket of assets like an index fund. Unlike mutual funds, ETFs trade like stocks on an exchange. They often have lower fees and offer more flexibility in trading.

4. The Role of Risk in Investing

Risk in investing refers to the possibility of losing some or all of the original investment. Different types of investments come with different levels of risk:

- High risk investments (like stocks) offer the potential for high returns but also higher chances of loss.

- Low risk investments (like government bonds or savings accounts) provide lower returns but are much safer.

- Risk tolerance is an individual's comfort level with the potential ups and downs of their investment value. Understanding your own risk tolerance is crucial in shaping your investment strategy.

5. Building a Diversified Investment Portfolio

Diversification is a strategy to reduce risk by spreading investments across various financial instruments, industries, and other categories. It aims to maximize returns by investing in different areas that would each react differently to the same event. Although it doesn’t guarantee against loss, diversification is the most important component of reaching long-range financial goals while minimizing risk. This could include:

- Stocks and bonds: A mix of these can help balance risk and reward.

- International investments: These can provide growth in different economic conditions.

- Sector funds: These can focus on specific industry sectors like technology, healthcare, or energy.

By understanding each of these components in detail, you can make more informed decisions about where to place your money, balancing potential gains with acceptable risks. Remember, the goal is not just to invest, but to invest wisely.

Trending News

No news available for this ticker. Please try again later, or another ticker