MACD Stock Scanning

Understanding and capitalizing on MACD to scan for breakout stocks

Last updated: March 26, 2023

Author: Nathan Nobert

Understanding the MACD Indicator

Before we dive into the process of scanning stocks using the MACD, it's crucial to understand what the MACD indicator is and why it's a valuable tool for traders and investors.

The Moving Average Convergence Divergence (MACD) is a versatile trading indicator used in technical analysis. It's designed to reveal changes in the strength, direction, momentum, and duration of a stock's price trend. The MACD is a trend-following momentum indicator, meaning it's used to identify the direction of a trend and measure its momentum.

The MACD consists of two lines and a histogram. The first line, known as the MACD line, is the difference between two exponential moving averages (EMAs) of a stock's price, typically the 12-period and 26-period EMAs. The second line, called the signal line, is a 9-period EMA of the MACD line. The histogram represents the difference between the MACD line and the signal line. Below you can see the MACD indicator in use on a chart.

Key Takeaways

- - Why the MACD is a great indicator

- - How to use the MACD for stock scanning

- - Creating a MACD stock screener

- - The benefits of using a stock scanner for MACD scanning

Why Use the MACD for Stock Scanning?

The MACD is a popular choice for stock scanning for several reasons:

Trend Identification: The MACD can help traders identify potential bullish and bearish trends. When the MACD line crosses above the signal line, it generates a bullish signal, suggesting it might be a good time to buy. Conversely, when the MACD line crosses below the signal line, it generates a bearish signal, indicating it might be a good time to sell.

Momentum Measurement: The MACD is excellent at gauging the strength of a price trend. When the MACD line and the signal line are far apart, it indicates a strong trend. When they're close together, it suggests the trend is weakening.

Divergence Detection: Divergences between the MACD and price action can signal a potential trend reversal. For example, if a stock's price reaches a new high, but the MACD doesn't, it could indicate that the upward trend is losing momentum and a bearish reversal may be on the horizon.

Ease of Interpretation: The MACD's visual components make it easy to interpret, even for beginners. The crossovers and divergences are straightforward to spot, and the histogram provides a clear visual representation of the difference between the MACD line and the signal line.

By using the MACD for stock scanning, traders and investors can quickly and easily identify potential trading opportunities. It's a powerful tool that, when used correctly, can enhance your trading strategy and help you make more informed trading decisions.

When analyzing this chart using MACD, we can see various points where the MACD and the signal line cross. Following the cross in an upwards trend identified an upswing, and conversely when the signal crossed down over the MACD the charts pulled back.

With this understanding of the MACD and its utility in stock scanning, we can now delve into how to use a stock scanner to scan stocks using the MACD indicator. A stock scanner can provide immediate notifications on when a stock meets your conditions and criteria! Imagine if you could scan the whole stock market for when the MACD line crosses the signal, lets do it!

Scanning the Stock Market with MACD

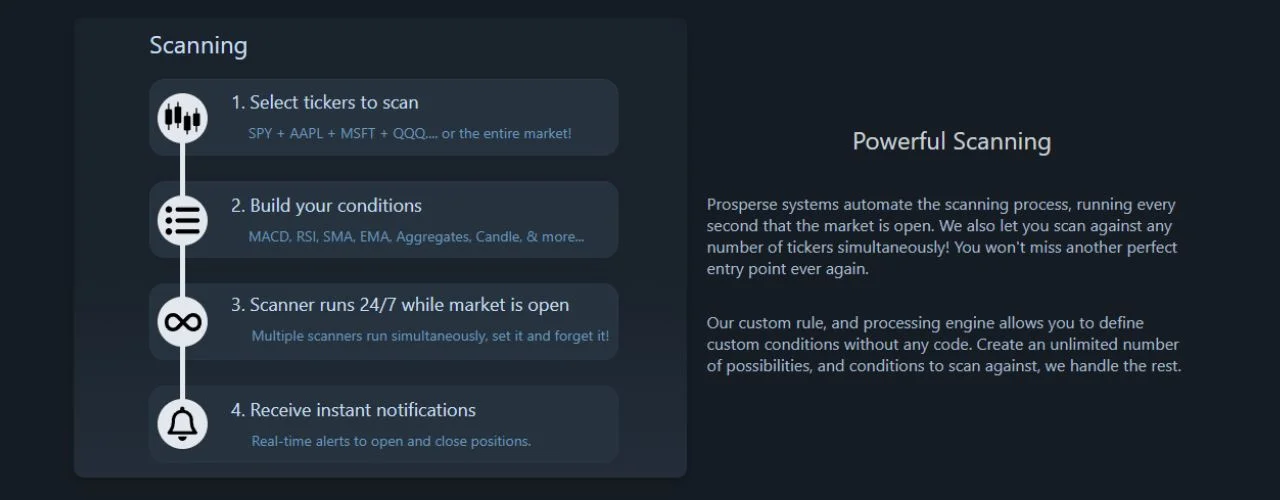

Prosperse is an advanced stock scanner that allows traders and investors to scan the stock market based on a variety of technical indicators, including the MACD. With its user-friendly interface and powerful scanning capabilities, its easy to identify potential trading opportunities.

To use Prosperse for MACD stock scanning, follow these steps:

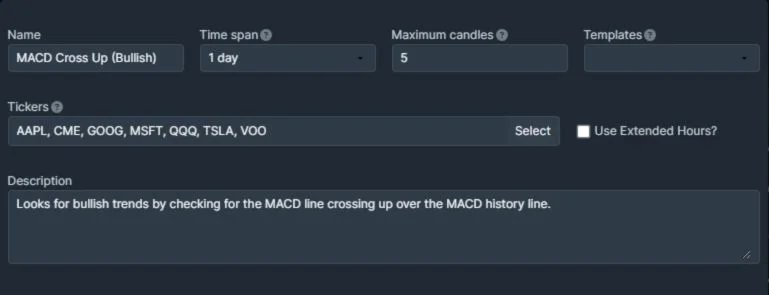

Navigate to Scanners: Once logged into

Prosperse select Scanners from the navigation menu.Create a New Scanner: Select New, and a popup window will appear, which will give you everything you need to create a new scanner.

Set Required Fields: Populate the basic fields first such as Name, Time span, and the Tickers you want to scan on. Keep in mind that Prosperse can scan against an unlimited number of tickers, simultaneously for you, automatically!

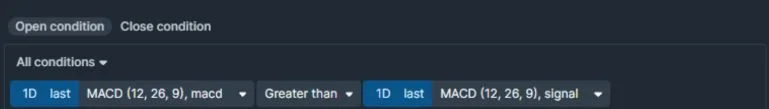

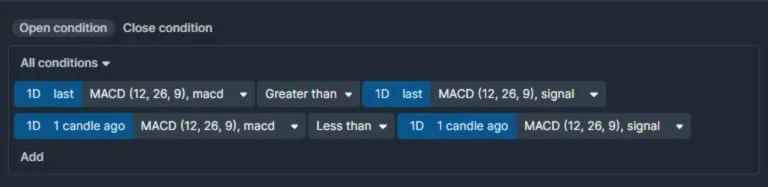

Add a MACD Condition: We will add a condition to check if todays MACD line is greater than todays signal line.

Add a Signal Condition: We will add another condition to check if yesterdays MACD line is less than todays signal line.

Now save your scanner and wait! When the market is open, you will be instantly notified of any stocks that meet these criteria. Feel free to make any adjustments to these conditions, or try this scanner in our backtester to see how this may have performed over the last 10+ years of market data!

The Benefits of Using a Stock Scanner for MACD Scanning

Using a stock scanner offers several benefits:

Efficiency: A stock scanner can scan the entire stock market in a matter of seconds, saving you a significant amount of time compared to manual scanning.

Accuracy: Stock scanners use precise algorithms to scan the market, reducing the risk of human error.

Customization: With a stock scanner, you can customize your scan criteria to fit your trading strategy and risk tolerance.

Accessibility: Most stock scanners, including Prosperse.com, are accessible online, allowing you to scan the market from anywhere with an internet connection.

In conclusion, using a stock scanner to scan stocks using the MACD indicator can be a game-changer for your trading strategy. It not only saves time and increases accuracy but also allows for customization and accessibility. By leveraging the power of technology, you can make more informed trading decisions and potentially increase your profitability in the stock market.

Remember, the key to successful trading is not just about having the right tools, but also about understanding how to use them effectively. Today, we are offering any new users with Prosperse 30% off their next purchase with coupon code SCANMACD30. Click the button below to register and start scanning today!

Read more here

Trending News

No news available for this ticker. Please try again later, or another ticker