Optimizing Your Investment Strategy: The Power of Portfolio Watchlists

Why Watchlists Are Essential for Savvy Investors

Last updated: Feb 6, 2024

Author: Nathan Nobert

In the fast-paced world of investing, staying informed and agile is paramount. One of the most effective tools at an investor's disposal is the portfolio watchlist. A well-curated watchlist acts as a beacon, guiding investors through the tumultuous seas of the stock market. It's not just about tracking stocks; it's about refining your investment approach to align with evolving market conditions and personal financial goals.

In today's fast-paced financial landscape, investors frequently search terms like "NYSE today" or "best stocks to buy now" for quick market insights. Such searches underline the urgency for real-time data and actionable information. While these queries offer snapshots of market trends, they lack the personalized and strategic framework provided by a well-curated watchlist.

This is where the true value of a watchlist becomes apparent—it not only offers customized monitoring of selected stocks but also integrates seamlessly with your investment strategy, giving you a competitive edge

Key Takeaways

- - The role of watchlists for traders and investors

- - Modern Investment Strategies Rely on Watchlists

- - Building a Watchlist: The Foundation of Effective Portfolio Management

- - Leveraging Advanced Features for Strategic Advantage

The role of watchlists for traders and investors

Watchlists have become an integral component of modern investment strategies, serving multiple functions beyond mere observation. They enable investors to monitor the performance of potential investment targets, track market movements, and receive alerts on key financial events. This constant flow of information allows for timely decisions, enabling investors to capitalize on opportunities or mitigate risks swiftly.

In today's investment landscape, where market dynamics can shift rapidly, having a structured way to keep tabs on chosen stocks is invaluable. Watchlists facilitate this by offering a personalized dashboard that reflects an investor's research, insights, and strategic outlook.

Whether it's tracking the bullish momentum of a tech startup or the steady dividends of a blue-chip firm, watchlists provide a structured snapshot of the market segments that matter most to the individual investor. If you're a newer investor, you may also be interested in our article on

Modern Investment Strategies Rely on Watchlists

The concept of watchlists is not new. Historically, investors would maintain physical lists of stocks they were monitoring, often accompanied by a ledger of prices and news clippings related to their interests. However, the digital transformation has revolutionized how watchlists are created and utilized.

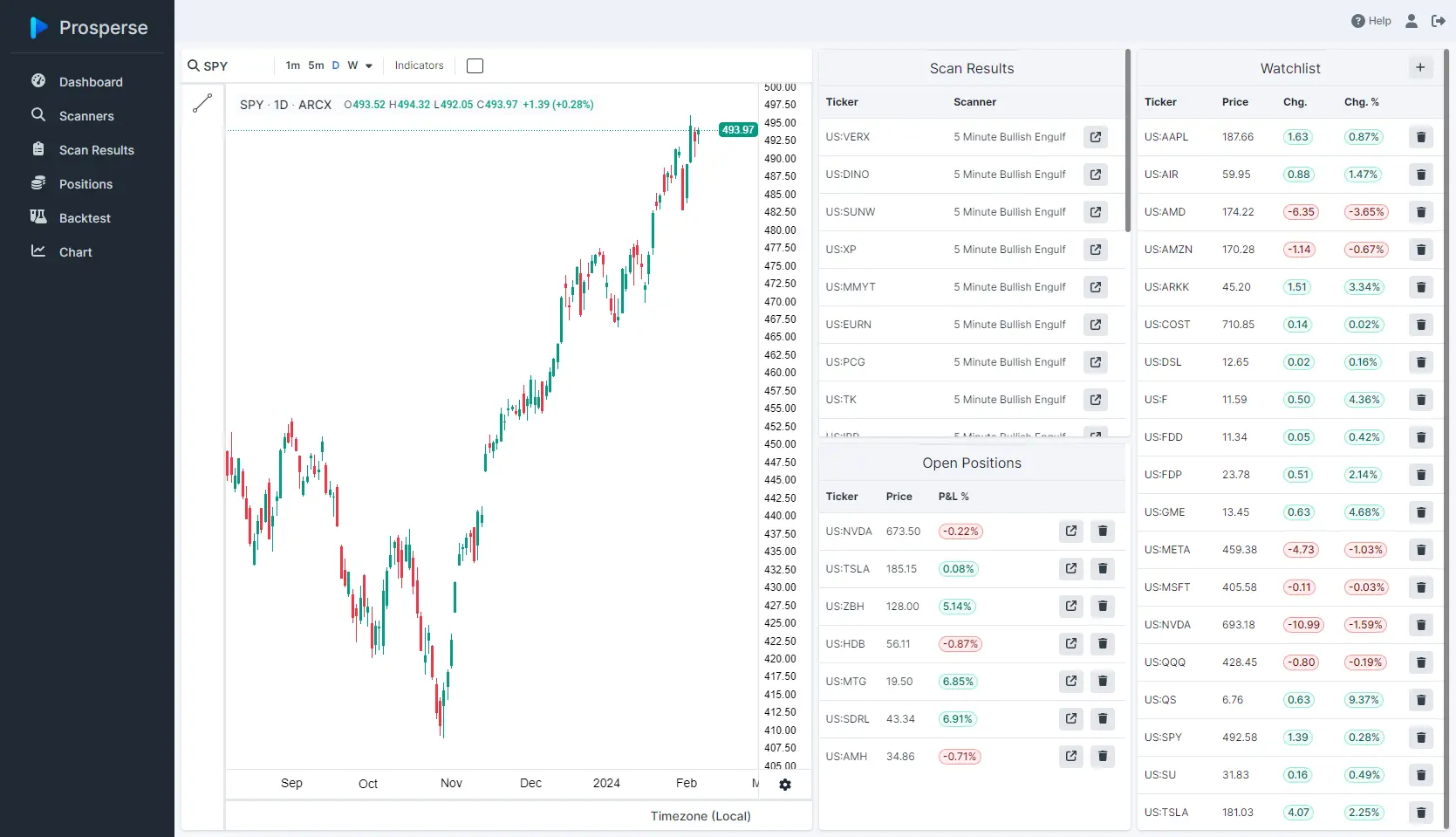

Modern digital tools and platforms have elevated the humble watchlist from simple lists to dynamic, data-rich interfaces. Today's watchlists can be customized with various metrics, including real-time pricing, volume analysis, historical performance data, and predictive analytics.

Integration with stock screeners allows investors to filter through thousands of stocks based on specific criteria, adding another layer of precision to the watchlist process.

Furthermore, advanced digital tools offer the capability to set alerts based on price movements, earnings announcements, or technical indicators, ensuring that investors never miss a beat.

These alerts can be tailored to an investor's strategy, whether they're a day trader looking for volatility or a long-term investor waiting for the right entry point into a fundamentally strong company.

Advanced tools which that leverage stock screeners and technical analysis use watchlists as a foundation for investment strategies. You can read these articles on

Benefits of Using a Watchlist

- Real-Time Monitoring: Keep a close eye on the performance of stocks you're interested in, allowing for quick reaction to market changes.

- Efficiency: Saves time by focusing only on pre-selected stocks, rather than sifting through the entire market.

- Strategic Planning: Helps in planning entry and exit strategies for trades by monitoring movements and trends of chosen stocks.

- Opportunity Identification: Quickly identify potential investment opportunities as soon as they arise, based on set criteria or alerts.

- Market Awareness: Stay informed about the overall market environment and how it affects the stocks on your watchlist.

- Learning Tool: Serve as an educational tool to study market trends, stock behaviors, and the impact of external factors on stock prices.

- Convenience: Access your watchlist across multiple devices, ensuring you have the information you need wherever you are.

Utilizing Watchlists to Enhance Your Investment Strategy

A well-managed watchlist is more than just a list of stocks; it's a crucial component of a sophisticated investment strategy. It aids in timing the market with precision and plays a vital role in risk management. Let's explore how a single, well-curated watchlist can become a powerful asset in enhancing your investment approach.

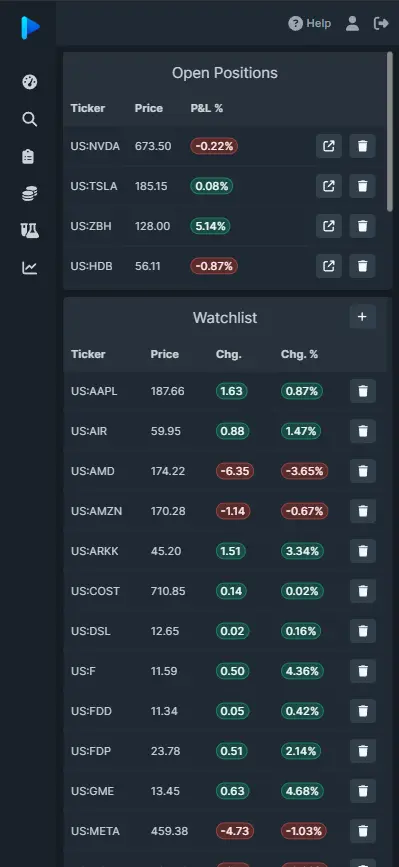

Mobile Watchlist Access

The Prosperse platform allows you to access your watchlist from anywhere. Whether you are on your phone, tablet, or computer, you can easily access your watchlist and make informed decisions on the go. While we primarily suggest using at least a tablet or computer to interact with Prosperse, you can still access your watchlist from your phone.

Timing the Market with Precision

One of the perennial challenges investors face is timing the market—knowing when to buy or sell for optimal returns. While it's widely acknowledged that perfectly timing the market is nearly impossible, a watchlist can significantly improve your ability to make informed decisions.

How Watchlists Can Help You Identify Buy and Sell Signals

Your watchlist serves as a focused lens on the market, allowing you to monitor the performance and volatility of selected stocks closely. By tracking these stocks over time, you become attuned to their patterns and behaviors, which can help you identify potential buy or sell signals based on technical indicators, news events, or financial milestones.

For example, adding a stock to your watchlist because it's approaching a significant support level allows you to watch for a bounce-back or a breakthrough, signaling a buying or selling opportunity. Similarly, tracking a stock nearing its earnings report can prepare you for potential volatility, offering a strategic entry or exit point based on the outcome.

Buy and sell signals are crucial for traders and investors. The goal of investing is to maximize returns while minimizing risk. By using a watchlist, you can identify buy and sell signals to help you achieve this goal. Finding stock picks can be challegning, thats why we have a guide on

Risk Management Through Diversification

Diversification is a cornerstone of effective risk management, and even with a single watchlist, you can achieve a diversified investment portfolio. The key is to carefully select a range of stocks from different sectors, industries, and risk categories to include in your watchlist.

Using Your Watchlist to Spread Risk and Discover Opportunities

By diversifying the contents of your watchlist, you can mitigate the impact of sector-specific downturns on your portfolio. For instance, including a mix of tech stocks, utilities, consumer goods, and healthcare companies can protect against sector slumps while positioning you to capitalize on growth opportunities

Furthermore, diversification within your watchlist can extend to stocks with varying market capitalizations, including a blend of large-cap, mid-cap, and small-cap stocks. This variety ensures you are exposed to the stability of blue-chip companies while also tapping into the growth potential of emerging businesses.

Leveraging Your Watchlist

Beyond the basic setup, the strategic use of advanced techniques can significantly enhance the utility of your watchlists. These methods not only streamline your investment process but also empower you to make decisions based on a refined analysis of market data.

Leveraging Stock Screeners with Your Watchlist

At Prosperse, we prioritize stock screening as a fundamental part of our investment process. Our stock screener is a powerful tool that allows you to filter through thousands of stocks based on specific criteria, ensuring that the stocks on your watchlist meet your investment strategy.

Build Your Watchlist Today

Once making an account with Prosperse, you will immediately have access to a pre-populated watchlist. This watchlist will be filled with some common, popular stocks on the market. You can then customize this list to fit your investment strategy.

If you find yourself searching google for terms such as "SPY today", "Nvdia Stock price", or "AAPL stock price", then you should consider creating a watchlist. This will allow you to easily track the stocks you are interested in.

Read more here

Trending News

No news available for this ticker. Please try again later, or another ticker