Stock Screeners as an Investment Tool

How to use stock screeners to invest in the stock market

Last updated: December 11, 2023

Author: Nathan Nobert

How stock screeners work

Stock screeners have become an indispensable tool for investors of all backgrounds, enabling them to efficiently navigate the vast sea of stocks and identify potential investment opportunities.

At their core, stock screeners are powerful software applications that allow users to filter and sort through extensive databases of stocks based on predetermined criteria. With just a few clicks, investors can narrow down their search to specific sectors, market capitalizations, price ranges, dividend yields, and various other fundamental or technical indicators.

For example, if an investor is interested in finding technology stocks with strong growth potential comparable to NVDA (Nvidia Corporation), they can set the screener to display only companies meeting specific revenue or earnings growth criteria. The flexibility offered by stock screeners allows investors to tailor their searches according to their own investment strategies.

Investors can take into account technical indicators like moving averages or relative strength index (RSI) values. They can also include sector-specific filters or exclude certain industries from their search altogether based on personal preferences.

Key Takeaways

- - How stock screeners work

- - How to get started with stock screeners

- - Using stock screeners to find stocks

- - Stock screener options

- - Using custom stock screeners

- - Stock screener example

How to get started with stock screeners

To begin, it's essential to select a reliable stock screener that suits your needs. There are numerous options available online, ranging from free versions to premium services.

It is important to consider factors like ease of use, accuracy of data, and availability of advanced features when choosing a stock screener. Once you have chosen a stock screener, it's time to familiarize yourself with its functionalities.

Most stock screeners have an intuitive user interface that allows for easy navigation and customization. The first step is typically selecting the industry, or some companies you are interested in.

You can then specify various criteria such as price range, market capitalization, sector/industry focus, dividend yield, and earnings growth rate. To make your screening process more efficient and precise, it's advisable to incorporate multiple filters simultaneously.

This is where research and due diligence come into play. It's important to understand the fundamentals of the companies you are interested in and how they compare to their peers. You can learn more about this in our article on

Technical analysis is also a useful tool for investors looking to identify potential investment opportunities. This is where you can filter stocks based on technical indicators like moving averages or other powerful indicators such as MACD (Moving Average Convergence Divergence) and RSI (Relative Strength Index). You can learn more about this in our article on

Using stock screeners to find stocks

Stock screeners are powerful tools that enable investors to quickly and efficiently filter through a vast universe of stocks based on specific criteria.

When using stock screeners for finding stocks, it's essential to start with a clear investment strategy in mind. Whether you're looking for growth stocks or value plays, the screener can be tailored accordingly. A good starting point is to learn about trading techniques such as

For instance, if you are seeking growth opportunities in the technology sector, you might focus on companies that are trending similarily to top tech stocks. Creating scenarios like this is easy with stock screeners and can help you find stocks that are similar to ones you already know. Furthermore, automated stock scanning is an excellent feature offered by many advanced stock screeners.

The main premise behind automated stock scanning is that it allows investors to set up a screener to automatically search for stocks that meet specific criteria. For instance, if you are looking for undervalued stocks with strong growth potential, you can set up a screener to automatically search for stocks with a low P/E ratio and high earnings growth rate.

Stock screener options

When it comes to stock screener options, investors are spoiled for choice. There is a wide range of stock screeners available, each with its own unique features and capabilities. Some popular options include Finviz, MarketSmith, and Yahoo Finance's stock screener.

If you've landed here, you're in luck! We've built a powerful stock analysis system that has all the features you need to find stocks that meet your criteria. You can check it out

Other features to consider when choosing a stock screener include the ability to save your searches and create watchlists. This is especially useful for investors who want to monitor specific stocks over time.

Charting capabilities are another important consideration when choosing a stock screener. Many stock screeners offer basic charting tools that allow investors to view historical price data and technical indicators like moving averages or RSI values. However, more advanced charting tools are available through premium subscriptions.

Data accuracy is another important factor to consider when choosing a stock screener. It's essential to ensure that the data provided by the screener is accurate and up-to-date. This is especially important for investors who are using stock screeners to make investment decisions.

Additional features to consider include the ability to create custom filters, backtesting, and alerts. Custom filters allow investors to create their own screening criteria based on specific fundamental or technical indicators. Backtesting is a useful feature that allows investors to test their strategies against historical data. Alerts are another useful feature that allows investors to receive notifications when stocks meet specific criteria.

Whether one is interested in finding undervalued stocks, high-growth companies, or dividend-paying securities, there is a stock screener out there to suit every investor's needs. By leveraging the power of these tools, investors can save time and quickly identify potential investment opportunities like TSLA or SPY stocks or even uncover hidden gems like NVDA.

Using custom stock screeners

Using custom stock screeners provides investors with a unique advantage in tailoring their investment strategies to meet their specific needs and preferences. Unlike pre-built stock screeners, which offer a limited number of predefined filters, custom stock screeners allow investors to incorporate their own criteria and indicators into the scanning process. This level of customization enables investors to focus on specific sectors, industries, or even individual stocks that align with their investment goals.

For instance, an investor interested in the electric vehicle industry may create a custom stock screener that includes filters such as "market capitalization greater than $10 billion" and "revenue growth rate exceeding 20%." By incorporating these criteria into the custom stock screener, the investor can identify potential investments in companies like TSLA (Tesla) or other promising players in this sector. In addition to sector-specific criteria, custom stock screeners also enable investors to include technical indicators and fundamental analysis metrics that are particularly relevant to their investment strategies.

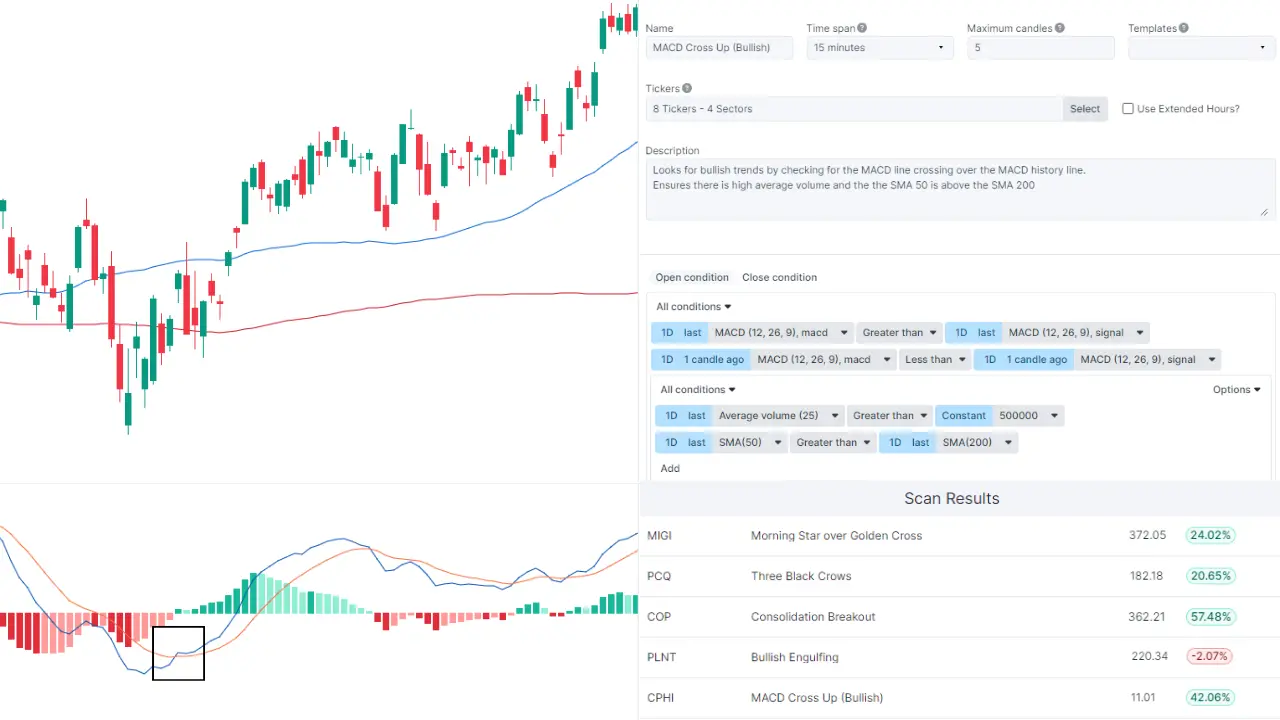

For example, an investor who follows a momentum-based strategy may choose to incorporate indicators such as moving average convergence divergence (MACD) or relative strength index (RSI) into their custom stock screener. These technical indicators can help identify stocks that are experiencing strong upward momentum or are potentially entering oversold or overbought territory.

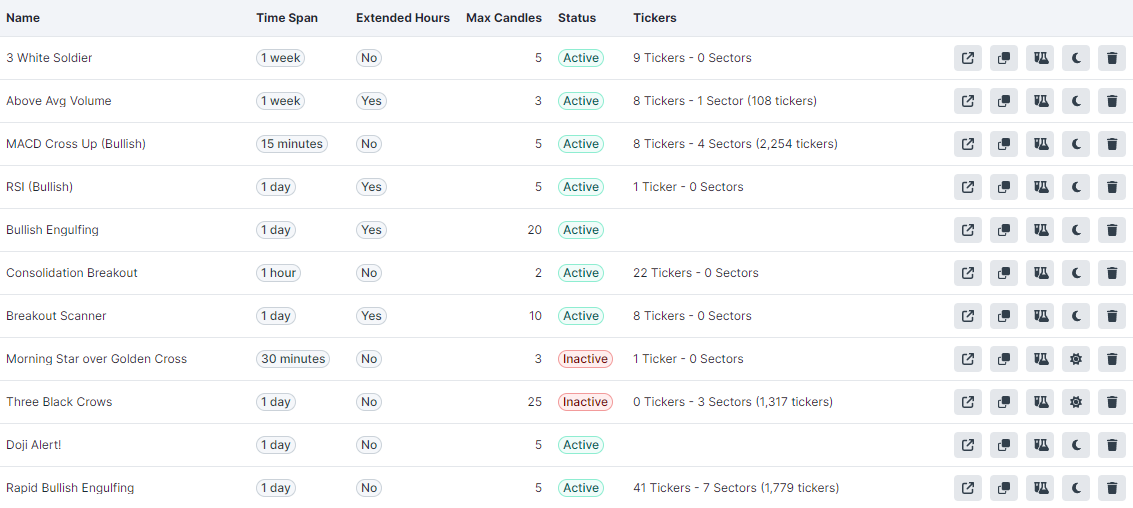

Prosperse's stock screener is a great example of a custom stock screener. It allows investors to create custom filters based on fundamental and technical indicators. Any custom conditions can be saved and will run automatically for you. You will receive notifications when stocks meet your criteria.

We also let you have many different custom stock screeners, so you can have one for each strategy you use. Each of them run simultaneously, so you can spend more time doing what you love, and less time searching for stocks.

This automation process not only reduces human bias but also allows investors to efficiently focus on analyzing the results generated by the custom stock screener. It is worth noting that while using custom stock screeners offers numerous benefits and flexibility in refining one's investment choices, it requires careful consideration and periodic recalibration.

Investors should regularly review and update their custom stock screeners to ensure the criteria and indicators used are relevant and aligned with their investment goals. Moreover, backtesting the performance of the custom stock screener against historical data can provide valuable insights into its effectiveness in generating profitable investment opportunities. We offer

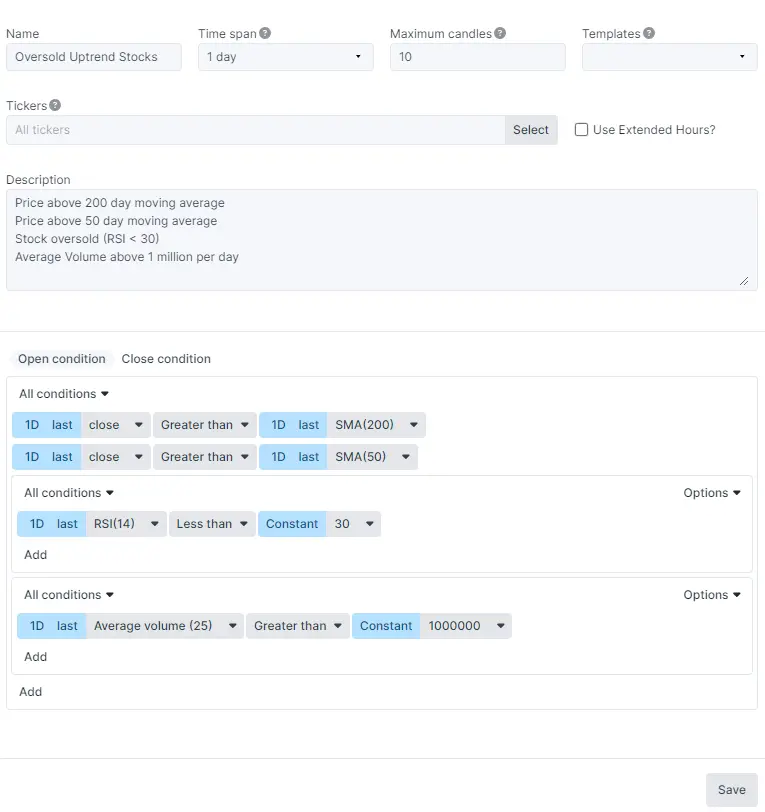

Stock screener example

We will focus our example on a technical analysis, using Prosperse's custom stock scanner. We will look for stocks that are in an uptrend, and are currently oversold. We will also look for stocks that have a high volume, which is a good indicator of a strong trend.

We will use the following filters:

- Price above 200 day moving average

- Price above 50 day moving average

- RSI below 30

- Volume above 1 million

All of this can be created with a custom stock screener in Prosperse as the following picture displays:

This scanner is now running 24/7 and will notify us when a result is found! The benefit of this automation is countless hours saved, and the ability to find stocks that meet your criteria without having to manually search for them.

We have other guides on creating custom screeners for more conditions,

Conclusion

Stock screeners are powerful tools that provide investors with a systematic and efficient way to filter through a vast universe of stocks. By utilizing the various features and options offered by stock screeners, investors can save time and effort in their search for potential investments.

Whether it's using pre-set filters or creating custom screens based on specific criteria, stock screeners offer flexibility and customization. Automated stock scanning has revolutionized the investment landscape, allowing investors to quickly identify opportunities and make informed decisions.

By leveraging these tools effectively, investors have a better chance of identifying profitable investment opportunities while minimizing potential risks. So next time you're planning your investment strategy, consider incorporating automated stock scanning through a reliable stock screener like Prosperse into your routine - it could be just what you need for successful investing.

Read more here

Trending News

No news available for this ticker. Please try again later, or another ticker