Getting Started Building a Trading Career Tools and Resources Glossary - Backtesting

- Backtesting Depth

- Bear Market

- Bull Market

- Candlestick

- Charting

- Chart Patterns

- Day Trading

- Dividend Yield

- ETF

- Fundamental Analysis

- Leverage

- Limit Order

- Index Fund

- Margin Trading

- Market Capitalization

- Mutual Fund

- Market Trends

- Moving Averages

- Price-to-Earnings Ratio (P/E Ratio)

- Portfolio Diversification

- Positions in Prosperse

- Risk Management

- Scalping

- Short Selling

- Stock Alerts

- Stock Scanning

- Stock Screener

- Stop-Loss Order

- Support and Resistance

- Swing Trading

- Take Profit

- Technical Analysis

- Trend Lines

- Volatility

Glossary - Backtesting

Backtesting definition

A process used to test a trading strategy using historical data to see how it would have performed.Backtesting is the process of testing a trading strategy using historical data to see how it would have performed. This allows traders to evaluate the effectiveness of a strategy before applying it to real market conditions.

Use Cases

Imagine you have a strategy that buys stocks when their price crosses above the 50-day moving average and sells when it crosses below the 200-day moving average. By backtesting this strategy on historical data, you can see how it would have performed over time, helping you to refine the strategy before using it in real-world trading.

Historical Context

Backtesting has evolved with the advancement of computational power. In the early days, traders would manually go through charts and historical data to test their strategies. Today, platforms like Prosperse offer powerful backtesting tools that can analyze large datasets in seconds, providing traders with insights that would have taken days or weeks to compile manually.

Visual Aid

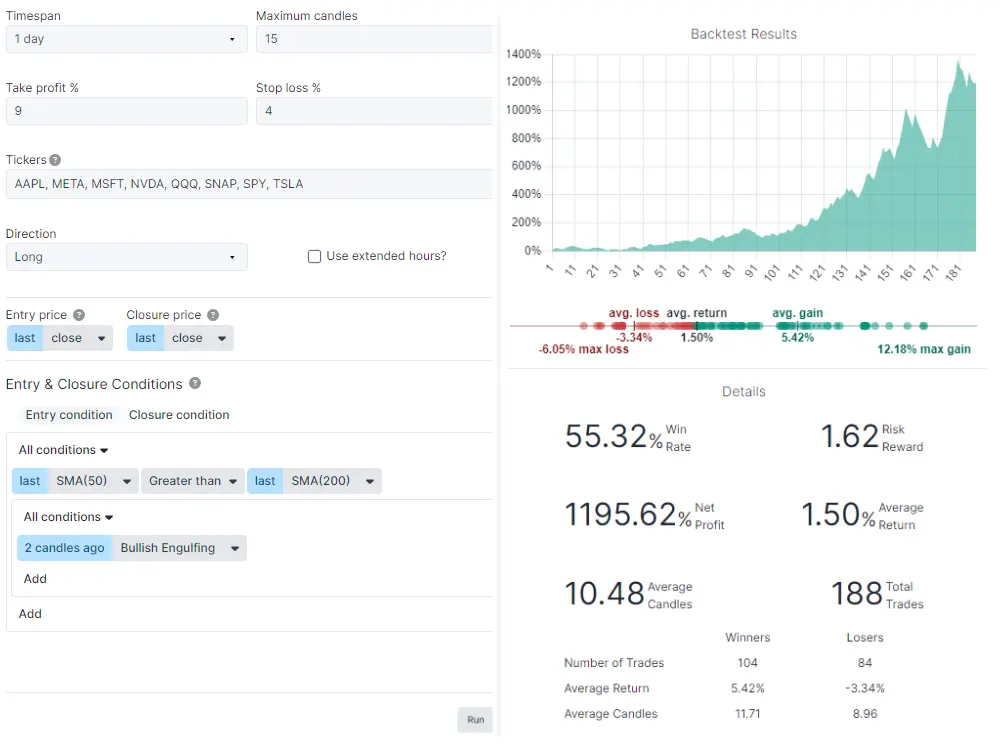

Here is an example of a backtesting strategy executed on Prosperse.

Backtesting a strategy on Prosperse, showing buy and sell signals based on moving averages.

Related Terms:

- Stock Screener: A tool that allows you to filter stocks based on specific criteria.

- Candlestick: A type of price chart that displays the high, low, open, and close prices of a security for a specific period.

Frequently Asked Questions

What is backtesting in trading?

Backtesting is the process of testing a trading strategy using historical data to assess its performance before applying it to current market conditions.

Why is backtesting important?

Backtesting helps traders evaluate the effectiveness and risk of a strategy, allowing them to refine their approach before committing real capital.

What are the limitations of backtesting?

Backtesting is based on historical data, so it may not account for future market conditions or unexpected events. Overfitting a strategy to historical data can also lead to poor performance in real trading.

How accurate is backtesting?

The accuracy of backtesting depends on the quality and range of historical data used. While it provides valuable insights, it should be used in conjunction with other forms of analysis.

Can I backtest multiple strategies simultaneously?

Yes, platforms like Prosperse allow you to backtest multiple strategies at once, helping you compare their performance under the same market conditions.

Is backtesting suitable for beginners?

Backtesting can be a great tool for beginners to learn about trading strategies and market behavior. Platforms like Prosperse offer user-friendly interfaces that make it easy to get started.

Can backtesting predict future performance?

No, backtesting cannot predict future performance. It is a tool for evaluating how a strategy would have performed in the past, but past performance does not guarantee future results.

What data should I use for backtesting?

High-quality, extensive historical data that reflects a wide range of market conditions is ideal for backtesting. This helps ensure that the strategy is robust and adaptable.

How often should I backtest my strategies?

It's a good idea to regularly backtest your strategies, especially when market conditions change or when you make adjustments to your trading approach.