Getting Started Building a Trading Career Tools and Resources Glossary - Backtesting

- Backtesting Depth

- Bear Market

- Bull Market

- Candlestick

- Charting

- Chart Patterns

- Day Trading

- Dividend Yield

- ETF

- Fundamental Analysis

- Leverage

- Limit Order

- Index Fund

- Margin Trading

- Market Capitalization

- Mutual Fund

- Market Trends

- Moving Averages

- Price-to-Earnings Ratio (P/E Ratio)

- Portfolio Diversification

- Positions in Prosperse

- Risk Management

- Scalping

- Short Selling

- Stock Alerts

- Stock Scanning

- Stock Screener

- Stop-Loss Order

- Support and Resistance

- Swing Trading

- Take Profit

- Technical Analysis

- Trend Lines

- Volatility

Glossary - Stock Screener

Stock Screener definition

A tool that allows you to filter stocks based on specific criteria.A stock screener allows investors to perform targeted searches based on various filters and criteria, helping them to identify potential investment opportunities that align with their specific strategies. Most stock screeners offer a wide range of filtering options, including but not limited to:

- Fundamental Filters: Such as earnings per share (EPS), P/E ratio, revenue growth, and dividend yield.

- Technical Filters: Including moving averages, relative strength index (RSI), and volume.

- Descriptive Filters: Such as market capitalization, industry sector, and stock price.

Stock screeners are often used by both long-term investors and short-term traders to identify stocks that match their criteria. For example, a value investor might use a stock screener to find undervalued companies by filtering for stocks with a low P/E ratio and high dividend yield.

Use Cases

Imagine an investor who is looking for companies in the technology sector with a market capitalization of over $10 billion, a P/E ratio below 20, and a dividend yield of at least 2%. By inputting these criteria into a stock screener, the investor can quickly generate a list of companies that meet these specific requirements, saving a significant amount of time compared to manually searching through each stock's financial statements.

Stock screeners can be used to find investment opportunities quickly, without needing to manually sift through hundreds or thousands of assets for specific criteria. Vast amounts of time can be saved by using stock screeners to filter out assets that do not meet the investor's criteria.

Historical Context

Stock screeners have evolved significantly from their origins in manual processes. Initially, investors would manually sift through stock data, but today, sophisticated digital tools allow for instant screening based on complex criteria.

Prosperse prioritizes automation as part of the stock screening process. Custom strategies and screeners can be made, saved, and will be used to scan the market 24/7 in real-time to alert users of potential opportunities.

Visual Aid

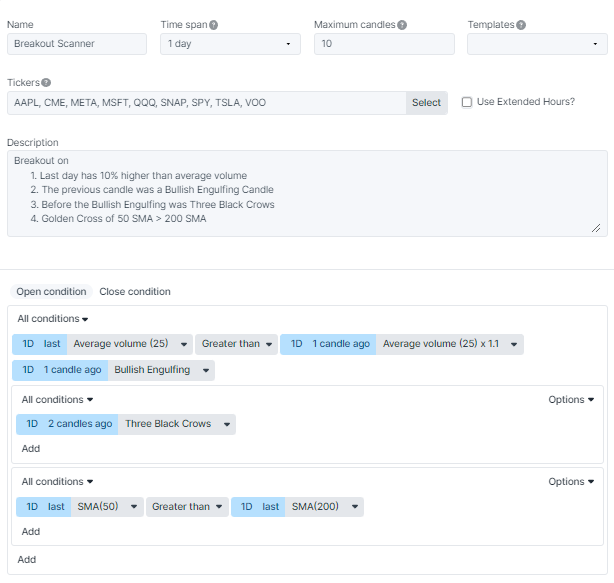

Here is a stock screener made up to search for breakout stocks using Prosperse

A stock screener made with Prosperse, indicating breakouts based on some technical indicators

When executing the stock screener, we can see results in a grid that provide us additional details such as price changes for the stocks. You can also navigate to relevant charts to do further technical analysis.

Related Terms:

- Backtesting: A process used to test a trading strategy using historical data to see how it would have performed.

- Candlestick: A type of price chart that displays the high, low, open, and close prices of a security for a specific period.

Frequently Asked Questions

What is a stock screener?

A stock screener is a tool that allows investors to filter and identify stocks based on specific criteria, such as financial metrics, technical indicators, and descriptive attributes. It helps investors to quickly narrow down a list of stocks that meet their investment strategies or goals.

How do I use a stock screener effectively?

To use a stock screener effectively, start by setting clear investment goals. Define the criteria that align with your strategy, such as market capitalization, P/E ratio, or dividend yield. Use the screener to filter out stocks that don’t meet these criteria, and then analyze the results in more detail to identify the best investment opportunities.

What are some common filters used in stock screeners?

Common filters in stock screeners include financial metrics like earnings per share (EPS), price-to-earnings (P/E) ratio, dividend yield, and market capitalization. Technical filters might include moving averages, relative strength index (RSI), and trading volume. Descriptive filters often involve industry sector, stock price range, and market cap categories.

Can I use a stock screener for short-term trading?

Yes, stock screeners can be very useful for short-term trading. Traders often use screeners to identify stocks with high volatility, specific chart patterns, or momentum indicators that suggest potential price movements in the short term.

Are stock screeners only for experienced investors?

No, stock screeners are designed for both beginners and experienced investors. While advanced investors may use more complex filters and criteria, beginners can start with basic filters like market cap and P/E ratio to identify stocks that fit their investment profile. Many platforms, including Prosperse, offer user-friendly interfaces that make it easy for beginners to get started.

How accurate are the results from a stock screener?

The accuracy of stock screener results depends on the quality of the data and the relevance of the filters applied. While a stock screener can help identify potential investment opportunities, it’s important to conduct further research and analysis to ensure that the stocks identified truly meet your investment criteria.

Can I save my stock screener filters for future use?

Yes, most stock screeners, including those on Prosperse, allow you to save your filter settings for future use. This makes it easy to quickly reapply your criteria without having to set up the filters from scratch each time.

Is it possible to combine multiple filters in a stock screener?

Absolutely! Combining multiple filters allows you to narrow down your search to stocks that meet very specific criteria. For example, you could filter for large-cap stocks with a low P/E ratio and high dividend yield, further refining your search to identify the best opportunities that align with your strategy.

How often should I update my stock screener criteria?

It’s a good practice to periodically review and update your stock screener criteria to ensure they align with your current investment strategy and market conditions. For instance, you might adjust your filters if you’re shifting from a growth-focused strategy to a value-oriented approach.

What are some limitations of stock screeners?

While stock screeners are powerful tools, they have limitations. They rely on quantitative data, which means qualitative factors like management quality, brand strength, or industry trends may not be fully captured. It’s also important to note that stock screeners cannot predict future performance; they simply help identify stocks that meet specific criteria based on historical data.