Getting Started Building a Trading Career Tools and Resources Glossary - Backtesting

- Backtesting Depth

- Bear Market

- Bull Market

- Candlestick

- Charting

- Chart Patterns

- Day Trading

- Dividend Yield

- ETF

- Fundamental Analysis

- Leverage

- Limit Order

- Index Fund

- Margin Trading

- Market Capitalization

- Mutual Fund

- Market Trends

- Moving Averages

- Price-to-Earnings Ratio (P/E Ratio)

- Portfolio Diversification

- Positions in Prosperse

- Risk Management

- Scalping

- Short Selling

- Stock Alerts

- Stock Scanning

- Stock Screener

- Stop-Loss Order

- Support and Resistance

- Swing Trading

- Take Profit

- Technical Analysis

- Trend Lines

- Volatility

Glossary - Day Trading

Day Trading definition

A trading strategy where traders buy and sell financial instruments within the same trading day.Day trading is a short-term trading strategy that involves buying and selling financial instruments within the same trading day. The goal is to capitalize on small price movements and generate quick profits, often using leverage to increase potential returns.

Use Cases

A day trader might buy a stock in the morning, aiming to sell it a few hours later as the price rises. They may use technical analysis, chart patterns, and news events to identify opportunities, often making multiple trades in a single day.

For example, a day trader might focus on a stock that has shown significant volatility due to an earnings announcement, aiming to capture quick gains from the price fluctuations.

Historical Context

Day trading became widely accessible in the 1990s with the advent of online trading platforms. What was once the domain of professional traders became available to retail investors, leading to the rise of day trading as a popular strategy. Today, it remains a high-risk, high-reward approach that requires skill, discipline, and a solid understanding of market dynamics.

Platforms like Prosperse offer tools specifically designed for day traders, including real-time data feeds, advanced charting capabilities, and fast execution speeds, helping traders make informed decisions quickly.

Visual Aid

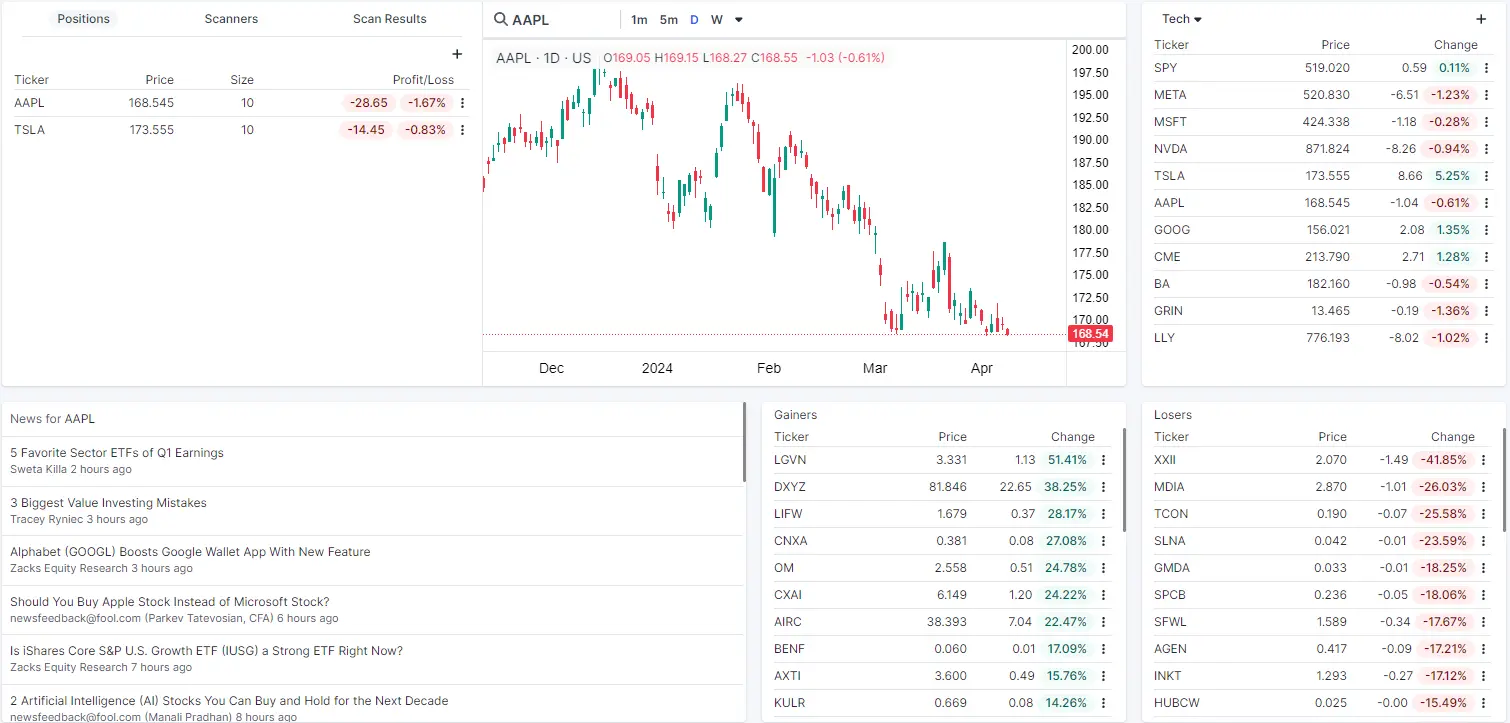

Here is an example of a day trading setup in Prosperse, highlighting key tools like real-time charts and order execution panels.

Day trading setup in Prosperse, featuring real-time charts and quick order execution tools.

Successful day trading often involves using these tools to react quickly to market movements and execute trades within minutes or even seconds.

Related Terms:

- Scalping: A trading strategy that involves making numerous small trades to profit from small price movements.

- Swing Trading: A trading strategy that involves holding positions for several days or weeks to capitalize on price swings.

Frequently Asked Questions

What is day trading?

Day trading is a strategy where traders buy and sell financial instruments within the same trading day, aiming to capitalize on short-term price movements.

How does day trading differ from other trading strategies?

Unlike swing trading or position trading, which involve holding assets for days, weeks, or longer, day trading focuses on quick, intra-day trades. Traders aim to take advantage of small price movements within a single day.

What tools do day traders use?

Day traders often use technical analysis, real-time charts, fast execution platforms, and news alerts to make quick trading decisions. Leverage is also commonly used to maximize potential gains.

Is day trading risky?

Yes, day trading is considered high-risk due to the fast-paced nature of the strategy, potential for large losses, and the use of leverage. It requires a solid understanding of market dynamics and strict risk management.

Can beginners start with day trading?

While it's possible for beginners to start with day trading, it's generally recommended to gain experience with other trading strategies first, as day trading requires quick decision-making and a deep understanding of the market.

How much capital do I need for day trading?

The capital required for day trading varies, but in the U.S., pattern day traders must maintain a minimum balance of $25,000 in their account. It's important to only use capital you can afford to lose, given the high-risk nature of day trading.

What are the most common day trading strategies?

Common day trading strategies include scalping, momentum trading, and breakout trading. Each strategy involves different techniques for entering and exiting trades quickly.

How do I manage risk in day trading?

Risk management in day trading involves setting stop-loss orders, limiting the amount of capital used per trade, and avoiding overtrading. It's crucial to have a well-defined trading plan and stick to it.